unemployment insurance tax refund

Blake Burman on unemployment fraud. The IRS said this spring and summer that it would automatically adjust the tax returns for people who hadnt taken the 10200 exclusion into account when filing and would.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

For some there will be no change.

. File a Quarterly Wage Report. In the latest batch of refunds announced in November however the average was 1189. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Tax Refunds On Unemployment Benefits Still Delayed For Thousands The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment. The unemployment benefits were given to workers whod been laid off as.

Generally for a refund to be approved the money that caused the credit must have been paid at least 21. The federal unemployment taxes paid to the Internal Revenue Service Form IRS 940 are used to pay the costs of administration of the unemployment insurance and Job Service programs in. View and print a copy of documents previously filed via the Internet.

The IRS has estimated that up to 13 million. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. So far the refunds have. However if as a result of the excluded unemployment compensation you now.

Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The average refund was about 1189.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. I request a refund of the credit balance on our unemployment insurance tax account.

Irs will start sending tax refunds on up to 10200 in unemployment insurance in may. Thats the same data the IRS released on November 1 when it announced that it had recently sent approximately 430000 refunds totaling more than 510 million. Because we made changes to your 2020 tax account to exclude up to 10200 of unemployment compensation you may be eligible for the Earned Income Credit.

State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010. Use the Internet Unemployment Tax and Wage System TWS to. People might get a refund if they filed their returns.

This taxable wage base is 62500 in 2022. The American Rescue Plan Act a pandemic relief law waived federal tax on up to 10200 of unemployment benefits per person collected in 2020 a year in which the. File Wage Reports Pay Your Unemployment Taxes Online Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account.

The average pay for an unemployment claim is 4200 but it can cost up to 12000 or more. Luckily the millions of people who are. According to the IRS the average refund is 1686.

The agency sent about 430000 refunds totaling more than 510 million in the last batch issued around Nov. WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund. The irs will automatically.

The unemployment tax refunds are determined by the employees earnings the length of time on unemployment and the states maximum benefit amount.

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Irs Sending Out Another 1 5 Million Tax Refunds To People Who Overpaid On Unemployment Benefits Cbs News

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Confused About Unemployment Tax Refund Question In Comments R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

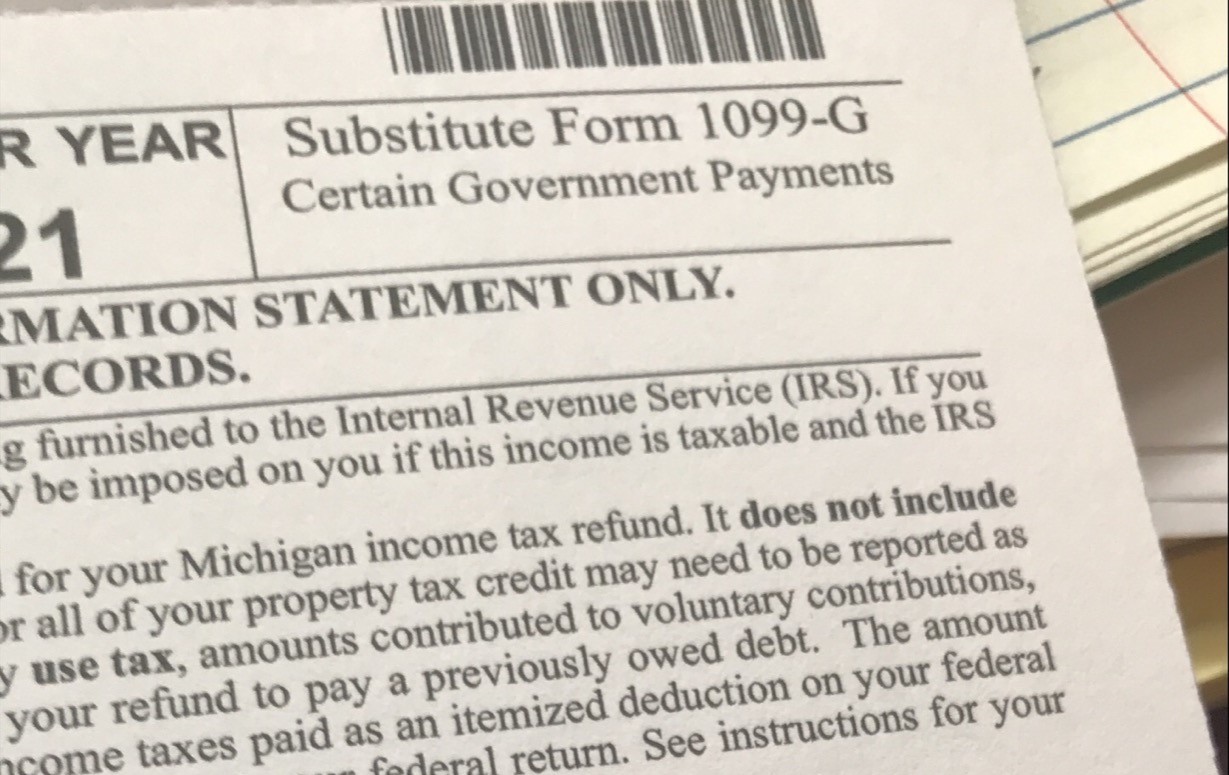

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

1099 G Unemployment Compensation 1099g

Irs Unemployment Refunds What You Need To Know

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas